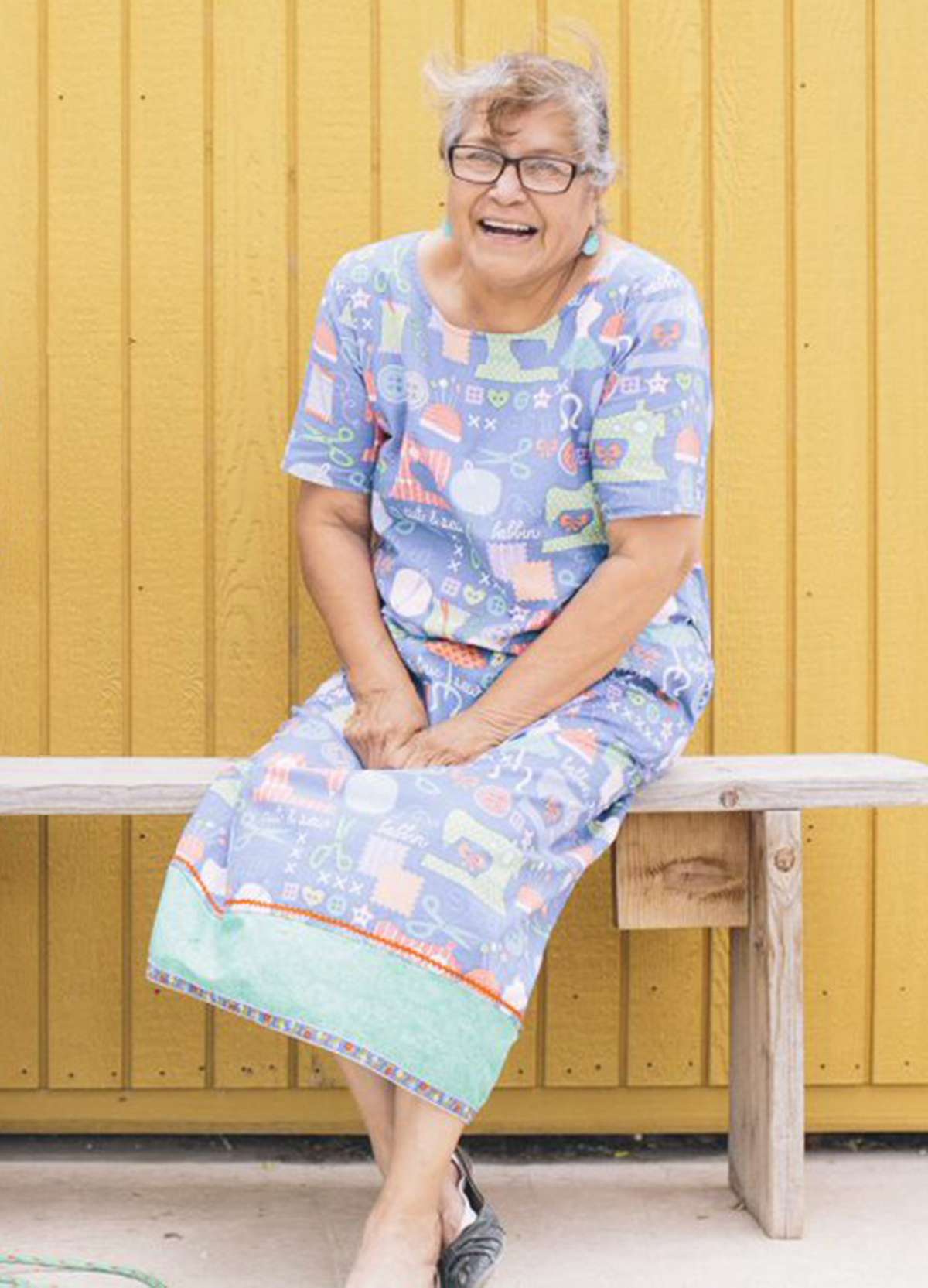

A member of Santa Ana Pueblo, Shirley grew up making her own clothes and was often asked by others where she had bought them. She realized she could use her gift to make clothes inspired by Native American culture as a way to preserve her family’s heritage. Shirley named her business RedWing Collections after the name her grandfather gave her: RedWing.

To get her company off the ground, Shirley needed new sewing equipment and capital to purchase supplies. A friend referred her to DreamSpring for a start-up loan.